We all stress about money, so why don’t we talk about it?

Three out of four Americans regularly stress out about money. That means that at any given time, the majority of us might be spinning in our heads with worry, shame, and anxiety about the very same thing—but none of us are talking about it. Money remains one of the major social taboos, and the secrecy only makes the problem worse.

But it doesn’t have to be this way—there are more resources than ever to help those experiencing financial distress. I spoke to some leading financial psychologists, therapists, and counselors about ways to manage emotional distress regarding money. Here’s what the experts say about our financial woes:

You’re not alone, and there’s nothing wrong with you

Every expert I spoke to emphasized with how many of us feel intense shame and guilt about our money problems. That’s partly because of the taboo around talking about money, and partly because society often equates money with intelligence, lovability, and oh, just, you know, our whole worth as human beings. The truth is, it’s none of those things. Here’s Brad Klontz, financial psychologist and author of “Mind Over Money”: “The biggest piece of information that I’d like to let people know is that their financial troubles are not the result of them being lazy, crazy, or stupid, and they’re not alone. If you’re stressed out about money, you’re the average American.”

Practice some honesty and intimacy with yourself—and with others

The worst thing about money shame is that it keeps us stuck in bad behaviors like avoidance, secrecy, and acting out through overspending or gambling. Simonne Gnessen, financial coach and co-author of “Sheconomics”, advises: “First of all, be intimate with yourself around money, know what’s coming in and going out ... And then share that financial intimacy.” By opening up to friends and family, and even asking them how they manage their finances, we can begin to break the sense of a guilty secret that keeps us stuck. You might even find that some of your nearest and dearest are suffering in the same way and that you can support each other.

Meditation helps

Each of the experts also strongly recommended a meditation practice, and not just because it can help with sleepless nights spent in desperate mental calculations (though that, too). Financial therapist Amanda Clayman tells me that financial mindfulness is a critical skill she teaches people. By “financial mindfulness,” she means the ability to stay present and be clear about what’s happening: “Not only in terms of the dollars and cents, and where those are moving in your life, but also in terms of what is authentically important to you.” Meditation is excellent for nurturing presence of mind and a constant sense of what really matters, so with a regular meditation practice, you’re less likely to be waylaid by destructive financial impulses. Brad Klontz has also seen great results through meditation. Part of the reason people “act out” financially, he says, is that whether it’s gambling, spending excessively, or another activity, the behavior often gives them a chemical high. If people feel empty, lonely, distressed, or anxious, they might seek out that chemical high as a temporary fix. In his practice, he says, he uses meditation as a way “to help people get connected to a much larger whole”—and if you’re feeling connected, as opposed to depressed or anxious or alone, you’re much less likely to indulge in self-destructive behaviors.

Some practical tips

First: don’t act when you’re in a state of high anxiety. A stress response, or fight-or-flight mode, says Amanda Clayman, “is not the best frame of mind to be, for example, evaluating complex information, thinking about consequences, running any sort of computation.” Meditation can help you get through those anxious moments, and can also keep them at bay in the longer term. Clayman also advises setting up a regular financial management practice that you protect the same way you would your meditation practice. Most of us only think about money when there’s a problem, and so it becomes a source of chronic stress. The idea of a regular practice is that it can help to decouple money from stress, which, in turn, will make us less likely to indulge in destructive behaviors. Klontz also has some great advice: ban the word “budget.” It functions in the same way as the word “diet,” he says, instantly making us feel hard-done-by and making it almost inevitable that we’ll stray from our targets. Instead, he advises putting together a “spending plan”: sitting down alone or with your partner to figure out what your goals are and what excites you, and using that information to put together a financial plan you can really get behind.

Digging deep

Remember Klontz’s key point? If you have money problems, they’re not the result of you being lazy, crazy, or stupid. “This is what they are the result of,” Brad tells me: “You have a set of money scripts, which are beliefs around money, that have been passed down to you from your parents, from your grandparents, sometimes from your great, great, great grandparents. And your financial situation right now is a direct result of these beliefs that you’ve been carrying around in your head since childhood. And if I, as a financial psychologist, was able to have a conversation with you and identify those beliefs, it would make perfect sense why you’re in the situation you’re in right now.” Short of visiting a financial psychologist, Brad recommends shedding some light on your money scripts by asking yourself questions: what three things did your mother teach you about money? What three things did your father teach you about money? What’s your most painful financial experience? Your most joyful financial experience? What are your biggest financial fears? By answering these questions and unlocking your historical family patterns, you can uncover the link between where you are now and the lessons you absorbed. In doing that, you’ll realize that your current position is completely natural, and nothing to be ashamed of. How could you have done anything different with the information and beliefs you had? Understanding and forgiving your past behavior in this way will enable you to take charge of your finances from here on out.

Meditation helps

Each of the experts also strongly recommended a meditation practice, and not just because it can help with sleepless nights spent in desperate mental calculations (though that, too). Financial therapist Amanda Clayman tells me that financial mindfulness is a critical skill she teaches people. By “financial mindfulness,” she means the ability to stay present and be clear about what’s happening: “Not only in terms of the dollars and cents, and where those are moving in your life, but also in terms of what is authentically important to you.” Meditation is excellent for nurturing presence of mind and a constant sense of what really matters, so with a regular meditation practice, you’re less likely to be waylaid by destructive financial impulses. Brad Klontz has also seen great results through meditation. Part of the reason people “act out” financially, he says, is that whether it’s gambling, spending excessively, or another activity, the behavior often gives them a chemical high. If people feel empty, lonely, distressed, or anxious, they might seek out that chemical high as a temporary fix. In his practice, he says, he uses meditation as a way “to help people get connected to a much larger whole”—and if you’re feeling connected, as opposed to depressed or anxious or alone, you’re much less likely to indulge in self-destructive behaviors.

Some practical tips

First: don’t act when you’re in a state of high anxiety. A stress response, or fight-or-flight mode, says Amanda Clayman, “is not the best frame of mind to be, for example, evaluating complex information, thinking about consequences, running any sort of computation.” Meditation for anxiety can help you get through those moments, and can also keep them at bay in the longer term. Clayman also advises setting up a regular financial management practice that you protect the same way you would your meditation practice. Most of us only think about money when there’s a problem, and so it becomes a source of chronic stress. The idea of a regular practice is that it can help to decouple money from stress, which, in turn, will make us less likely to indulge in destructive behaviors.

Klontz also has some great advice: ban the word “budget.” It functions in the same way as the word “diet,” he says, instantly making us feel hard-done-by and making it almost inevitable that we’ll stray from our targets. Instead, he advises putting together a “spending plan”: sitting down alone or with your partner to figure out what your goals are and what excites you, and using that information to put together a financial plan you can really get behind.

Digging deep

Remember Klontz’s key point? If you have money problems, they’re not the result of you being lazy, crazy, or stupid. “This is what they are the result of,” Brad tells me: “You have a set of money scripts, which are beliefs around money, that have been passed down to you from your parents, from your grandparents, sometimes from your great, great, great grandparents. And your financial situation right now is a direct result of these beliefs that you’ve been carrying around in your head since childhood. And if I, as a financial psychologist, was able to have a conversation with you and identify those beliefs, it would make perfect sense why you’re in the situation you’re in right now.” Short of visiting a financial psychologist, Brad recommends shedding some light on your money scripts by asking yourself questions: what three things did your mother teach you about money? What three things did your father teach you about money? What’s your most painful financial experience? Your most joyful financial experience? What are your biggest financial fears? By answering these questions and unlocking your historical family patterns, you can uncover the link between where you are now and the lessons you absorbed. In doing that, you’ll realize that your current position is completely natural, and nothing to be ashamed of. How could you have done anything different with the information and beliefs you had? Understanding and forgiving your past behavior in this way will enable you to take charge of your finances from here on out.

Be kind to your mind

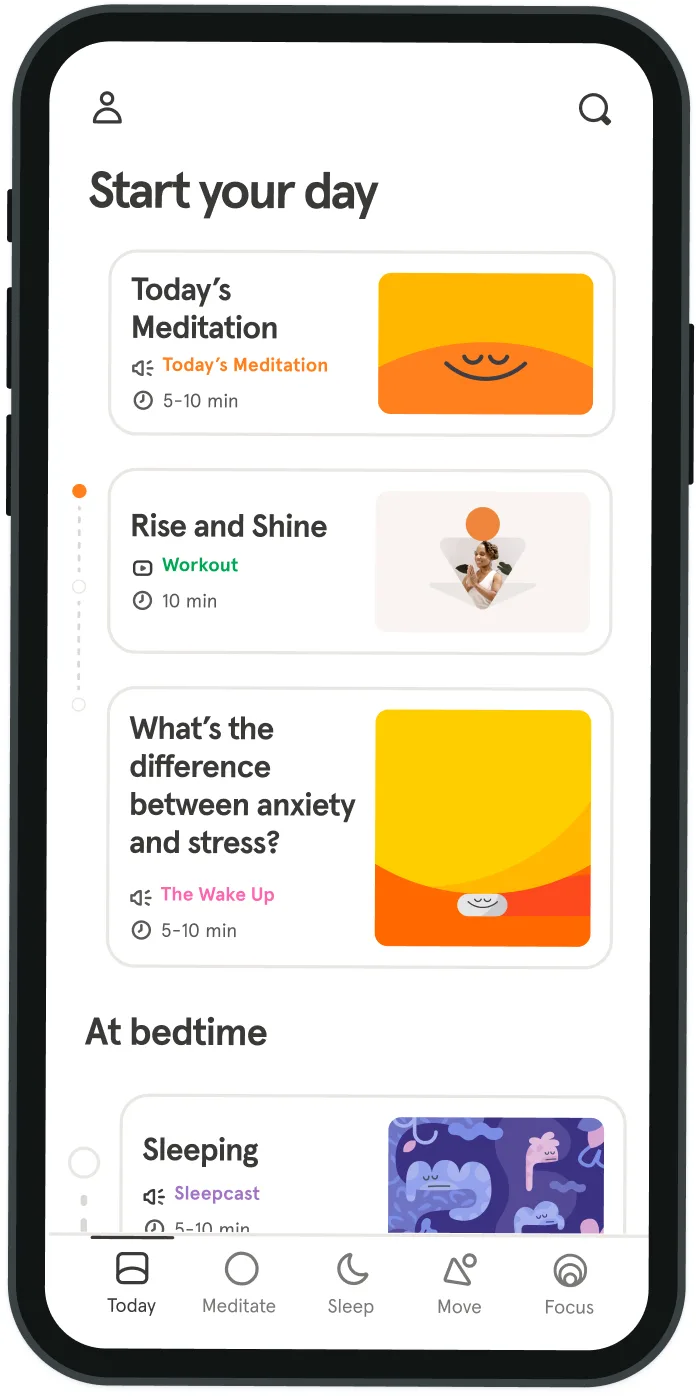

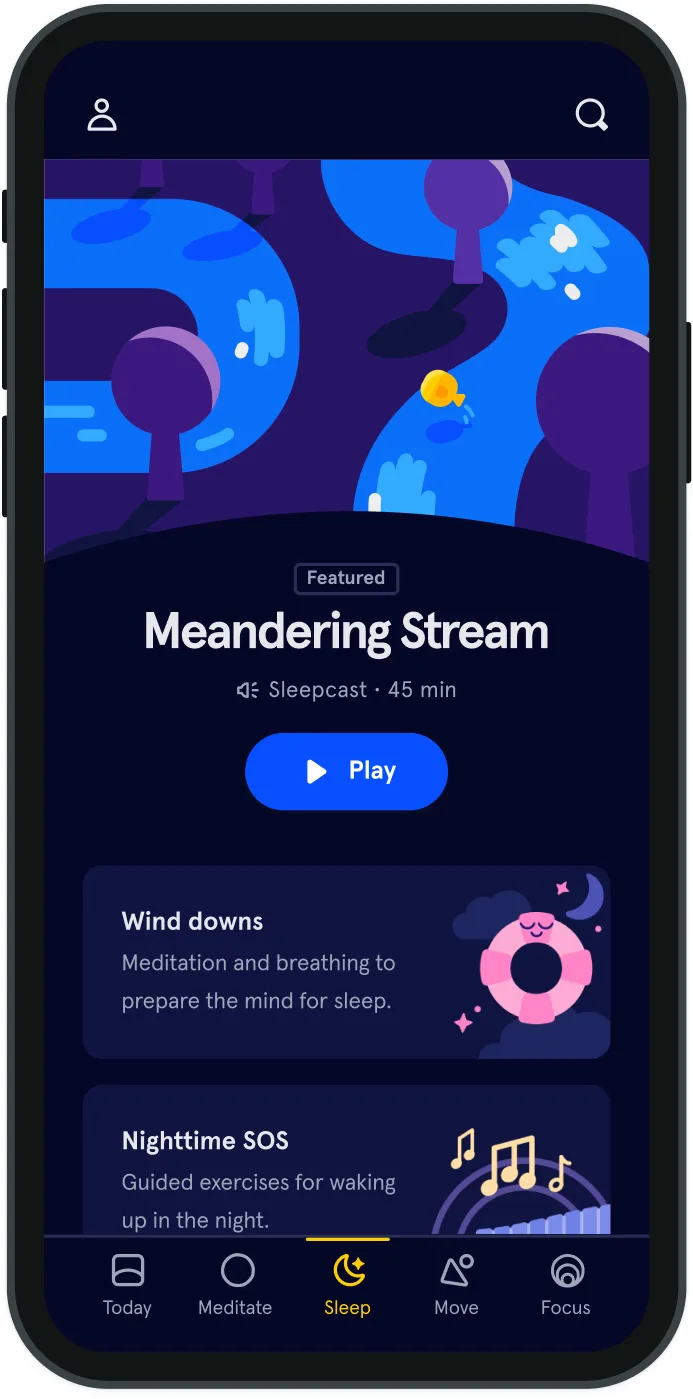

- Access the full library of 500+ meditations on everything from stress, to resilience, to compassion

- Put your mind to bed with sleep sounds, music, and wind-down exercises

- Make mindfulness a part of your daily routine with tension-releasing workouts, relaxing yoga, Focus music playlists, and more

Meditation and mindfulness for any mind, any mood, any goal

Stay in the loop

Be the first to get updates on our latest content, special offers, and new features.

By signing up, you’re agreeing to receive marketing emails from Headspace. You can unsubscribe at any time. For more details, check out our Privacy Policy.

- © 2025 Headspace Inc.

- Terms & conditions

- Privacy policy

- Consumer Health Data

- Your privacy choices

- CA Privacy Notice