How to splurge… mindfully

Whether we’re paying for a summer vacation, upgrading our bedroom furniture or charging a new pair of sandals, the urge to splurge is everywhere.

“From a very young age, we are bombarded by messages about … how happy we can be with things,” says Holly P. Thomas, founder of Holly P. Thomas, LLC, behavioral economist and author of “The Mindful Money Mentality: How to Find Balance in Your Financial Future.” “There aren’t many messages that tell us otherwise.” Careless spending that doesn’t align with our values is bound to catch up with us by sapping our resources and potentially landing us in debt. Could the principles of mindfulness also help us reach financial nirvana? Possibly, but only if we take it a step beyond simply being mindful. “Awareness alone isn’t enough,” says Susan Zimmerman, a chartered financial consultant and licensed marriage & family therapist. “[Being] mindful when it comes to money things is about being aware and attentive so you attend to your money based on the enlightened awareness you’re having.” Here are some strategies to get you started. Notice negative emotions The first step to curbing mindless spending is to catch yourself when you’re tempted. “Usually it’s triggered by some kind of heightened emotion,” Zimmerman says. “Stop and notice what the emotion is whether it’s excitement or an impulsive urge to splurge. If possible, name the emotion that’s been the driver of the impulsive idea.” Are you trying to self-soothe after a rough workweek? Or maybe you’re feeling jealous of your roommate’s new wheels? Notice these emotions, but don’t feel guilty or chastised about it. “We tend to be very self-loathing,” Zimmerman says. “You’re beating yourself up and calling yourself names. But with mindfulness it’s a very forgiving process. It’s about being nonjudgmental.” It’s OK to splurge on new shoes because you had a rough week at work (so long as you have the money), but make sure you understand your motivation before you purchase. Maybe other approaches like taking a long walk with a friend or soaking in in the bathtub would also improve your mood.

Breathe now, buy later Before you make a purchase you might regret, slowly inhale and exhale to let go of negativity. “Use breathing to reinforce the slowing down of the emotion,” Zimmerman says. “Focus on that conscious breathing and giving yourself the permission to notice what’s going on.” As you calm down, you’ll be able to identify spending triggers and think through the purchase more clearly. For big purchases, give yourself a cooling off period of at least 24 to 48 hours before you buy. You could save the item to a “buy later” Pinterest board or write it down in a notebook. “Writing things down and having that reinforcing stopping something before it happens,” Zimmerman says. “Those impulses do not last.” In a day or two, that purchase may not feel quite so important or urgent. Build off your existing habits. Thomas encourages consumers to improve on the spending strategy they currently use rather than trying to pull a 180-degree change. “Let’s say that one person likes to carry around a lot of cash, and another person likes to use a debit card,” she says. “In terms of trying to be mindful of their spending, I might have the debit card person pull up their balance more frequently than they were before.” That strategy would help debit or credit card users better understand where their money is going.

Zimmerman offers another strategy for consumers who rely on plastic: “Carry fewer credit [or debit] cards,” she says. “You can put rubber bands around it so to use it it takes longer to access. By the time you’ve removed the rubber bands, maybe you’ve realized it’s not a good idea.” Studies show that using plastic can shift consumer’s perceptions of cost. When we’re paying cash, we tend to spend less, because cash provides a more tangible reminder of money going out. If you’re using cash, Thomas recommends limiting the amount you withdraw daily or weekly instead of automatically running to the ATM whenever you run low. You can also allocate cash for different spending categories (rent, transportation, etc.) using separate envelopes. If one envelope runs short on cash, you can pull more money from another category, but you can’t take out more cash. Practice slowing down and thinking through purchases rather than spending on auto-pilot. This can help align your spending with your values and goals, which is good for your brain and your bottom line.

Practice slowing down and thinking through purchases rather than spending on auto-pilot

Susan Johnston Taylor

Be kind to your mind

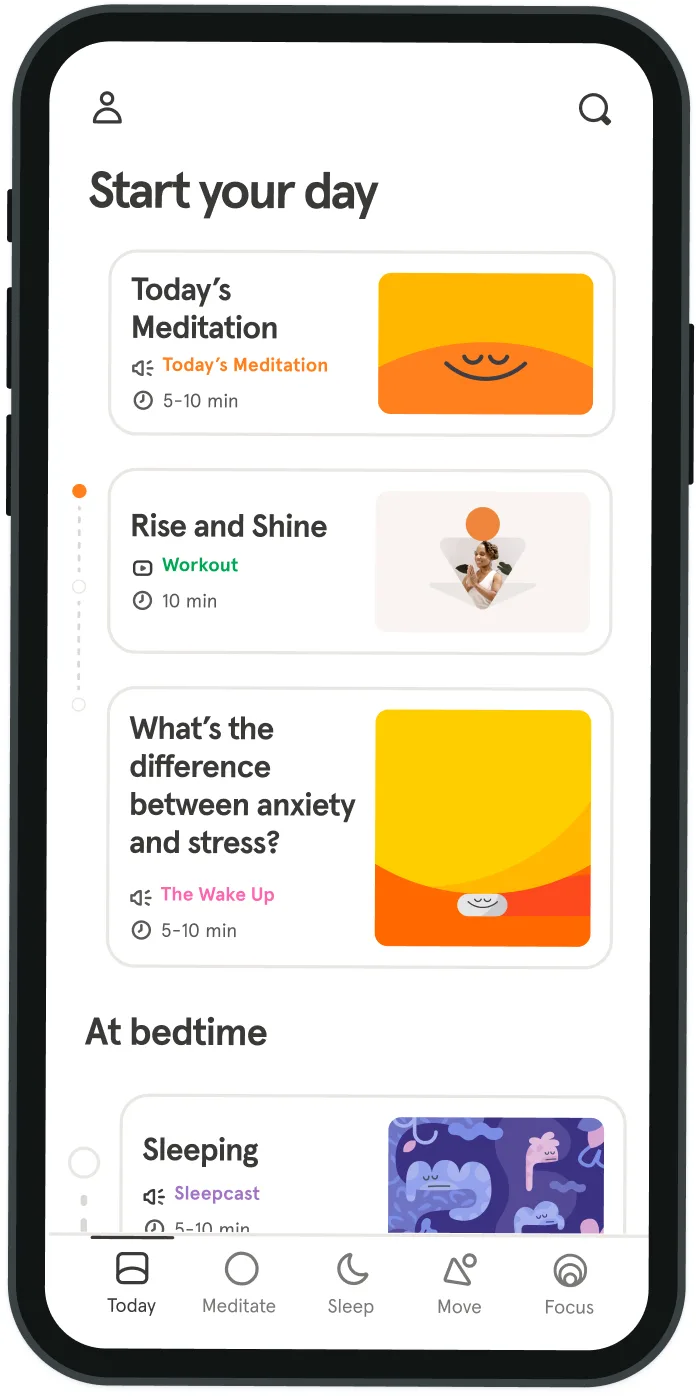

- Access the full library of 500+ meditations on everything from stress, to resilience, to compassion

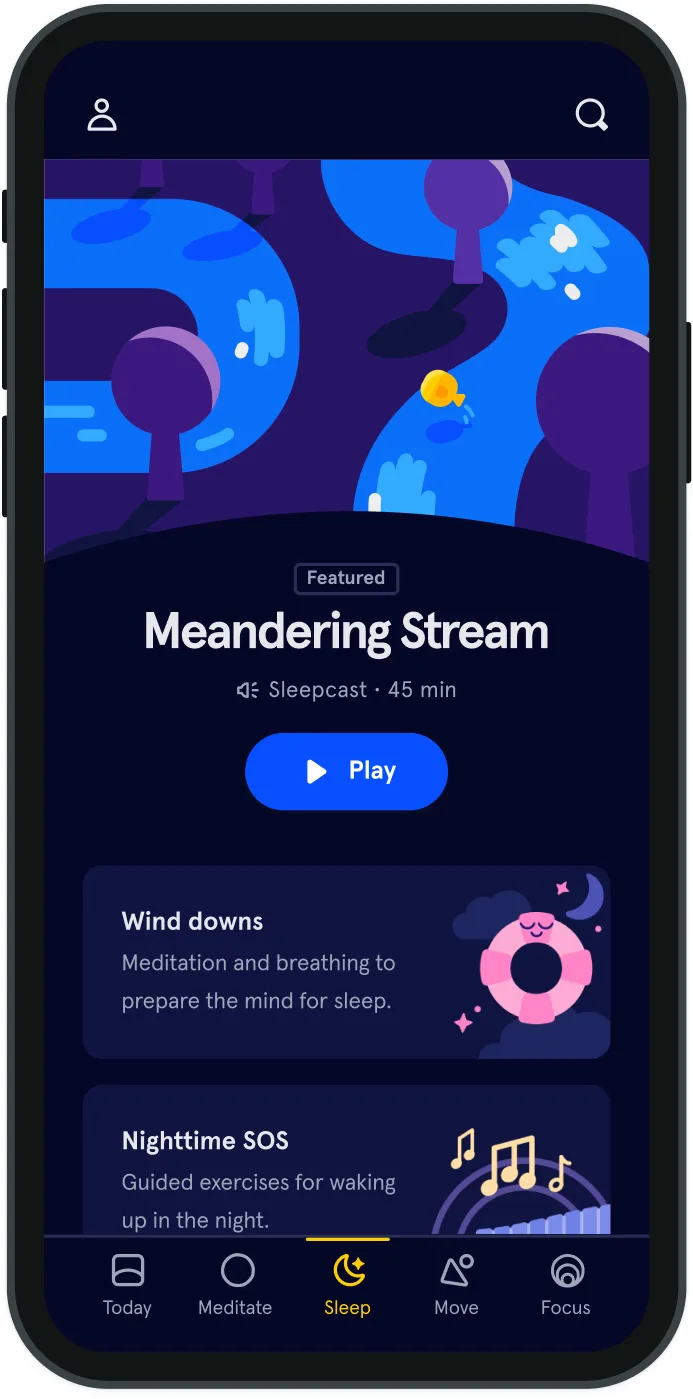

- Put your mind to bed with sleep sounds, music, and wind-down exercises

- Make mindfulness a part of your daily routine with tension-releasing workouts, relaxing yoga, Focus music playlists, and more

Meditation and mindfulness for any mind, any mood, any goal

Stay in the loop

Be the first to get updates on our latest content, special offers, and new features.

By signing up, you’re agreeing to receive marketing emails from Headspace. You can unsubscribe at any time. For more details, check out our Privacy Policy.

- © 2025 Headspace Inc.

- Terms & conditions

- Privacy policy

- Consumer Health Data

- Your privacy choices

- CA Privacy Notice