Are you afraid to check your bank account? 5 tips to get it back on track.

If you went a bit hog-wild with holiday cheer last month, you might be feeling a financial hangover from holiday spending. You’re not alone: the average American spent around $700 on holiday gifts in 2016. While the New Year is often about self-improvement, a financial-themed resolution is a popular one, and, if done well, could result in much less stress by next year.

I spoke to financial experts Rachel Cruze, author of “Love Your Life, Not Theirs: 7 Money Habits for Living the Life You Want”, and Kathleen Gurney, Ph.D., founder and CEO of Financial Psychology Corporation, for tips on how to get control of your money and reach your financial goals in 2017.

1. Quit comparing your life to others.

“[W]ith social media, it's so easy to compare our lives to everyone else's,” says Cruze. “Comparison not only steals your joy but it steals your paycheck because you end up spending money you may not have to take up this lifestyle of eating out and vacations and cars and [having stuff].” Start your new year by ditching comparisons, and find contentment and peace in your own life, suggests Cruze. “If you're content, it's easier to give, to save, and to get out of debt and to live the life you want,” she says. “Comparing yourself to others sidetracks you from getting ahead but it also doesn't help with what is it that you really want,” says Gurney. It’s important to use your money in a way it's going to satisfy you. Ask yourself, What do I trust? Should I really do this? Do I want it? before spending money based on what you see that others have, suggests Gurney_._ Using your money in a way that makes you happy is important. If you think that the social media accounts and retail e-newsletters cause you to want to shop, then eliminate that stimulation, as it’s often making you feel captive, says Gurney. Filter who you follow on social media so you’re seeing content that aligns with your values. “[W]e need to understand our own blind spots or personality pitfalls that keep tripping us up,” says Gurney. “Many people fail because they're absolutely not conscious. If you’re not conscious then you can't help yourself.”

2. Get on a budget.

People often dread creating a budget because, after they look at it, it makes them feel poor, says Gurney. People may think, “If I had more money, if I could get that raise, if I could get the job I want … then I wouldn't have to budget like this.” But the answer is that you would, because if you don’t have a budget, you're just going to go spend that extra money when it comes in, says Gurney. She finds that her clients who are in debt may feel depressed and think they’re never going to get out of it and that they’re just going to be on these revolving payments for their entire lives. Pay your fixed expenses first, but then look at what's discretionary. This can help you feel empowered because you decide how you want to use those funds. “I call them ‘planned exceptions’ and tell clients to put these into their budget,” says Gurney. This ‘fun fund’ could be once a month or once a week. Use this money to do or buy something that's going to bring you the greatest joy. Cruze also suggests keeping a “miscellaneous category” in your monthly budget for the unexpected things that come up. “A budget is going to give you limits and it's going to give you boundaries, but it gives you control and freedom to be able to spend money in a lot of categories and not stress about it,” says Cruze.

3. Get out of debt.

According to a 2015 survey, the average American household has about $15,675 of credit card debt, as well as about $132,000 total household debt which could include student loans, car loans, and a mortgage. “It’s mathematically important to be free from debt, but also emotionally,” says Cruze. “Debt not only steals income from you but it steals your peace of mind and it steals your sleep at night.” If you’re feeling overwhelmed by all the financial changes you want to make this year, today is the day to start. “If you’re sick and tired of getting the results you’ve been getting with your money … you have to change. Try a different way of doing things,” Cruze suggests.

4. Be prepared for frugal fatigue.

Usually, at about six weeks in, people get tired of and bored by budgeting their money, says Gurney. “You're going to feel some anxiety because your whole system is beginning to change. Change makes us feel anxious,” she says. Know that this “frugal fatigue” will come but that there are going to be some wonderful feelings of success on the other end. “Small steps successively taken will help you achieve your long-term goal,” says Gurney. If you find that you went on a shopping spree in a moment of weakness, just take the items back, she suggests. Don’t give up on your budget too quickly, Cruze advises. “I’ve found that the first month is pretty much a disaster. You don't really know what you spend; you're trying to guess. The second month it gets better. The third month it gets even better. Keep doing it and it’s eventually going to be like clockwork. It's going to seem so much more predictable,” she says.

5. Surround yourself with a financially fit team.

Accountability is important when it comes to reaching any goal and having a team to encourage and support you when you’re making changes will help you get there. If you’re married, work with your spouse and agree on where your money is going. “It's going to be difficult because money is never just about money. It brings up so many emotions, so many memories and things like that,” says Cruze. “People can get very defensive and the conversation may be hard, but push through and be united on the subject.” Single people who are trying to limit spending might want to get a few trusted friends in their corner and talk to them about what they’re doing. “Tell your friends the why behind your being on a budget,” says Cruze. “With healthy friendships, they're going to understand that and hopefully be excited for you.” While you might cut back on dinners out, consider hosting your friends for a potluck dinner at your place. Make sure they know that if you’re cutting back on your spending, it’s not because you don’t want to see them, but that you’re trying to get better control of your money.

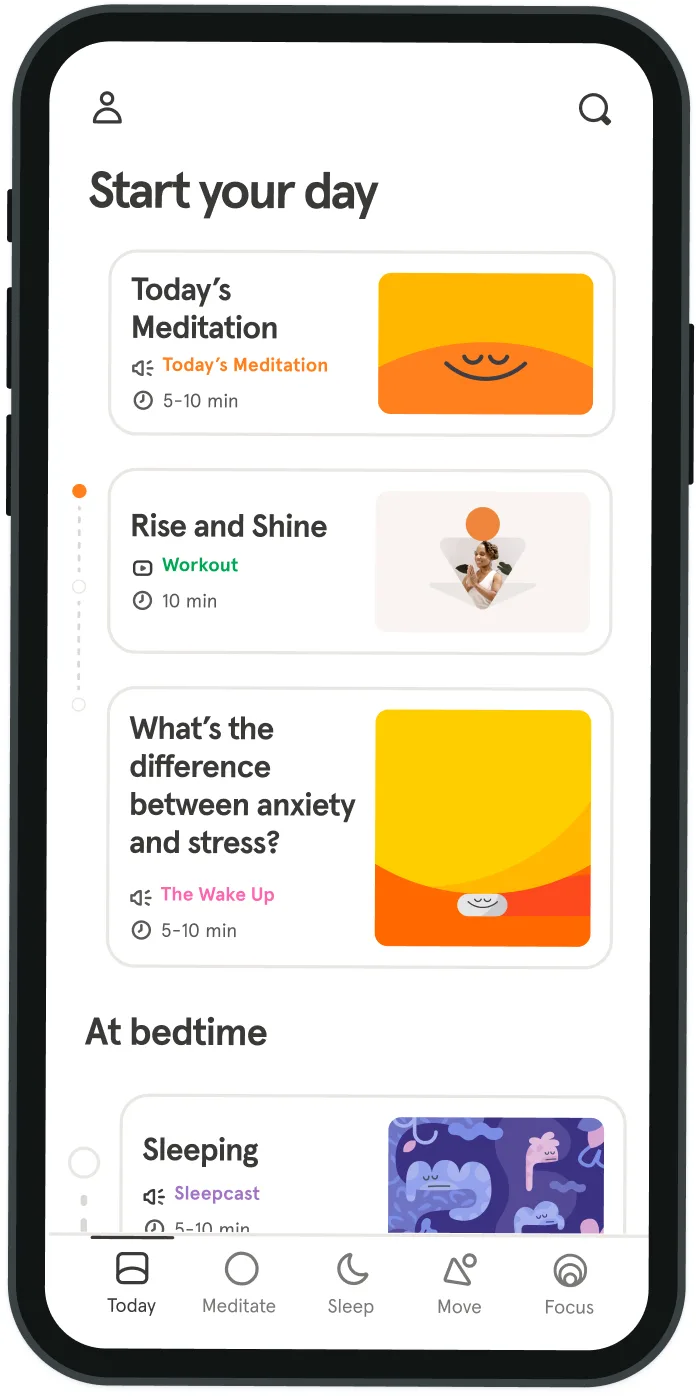

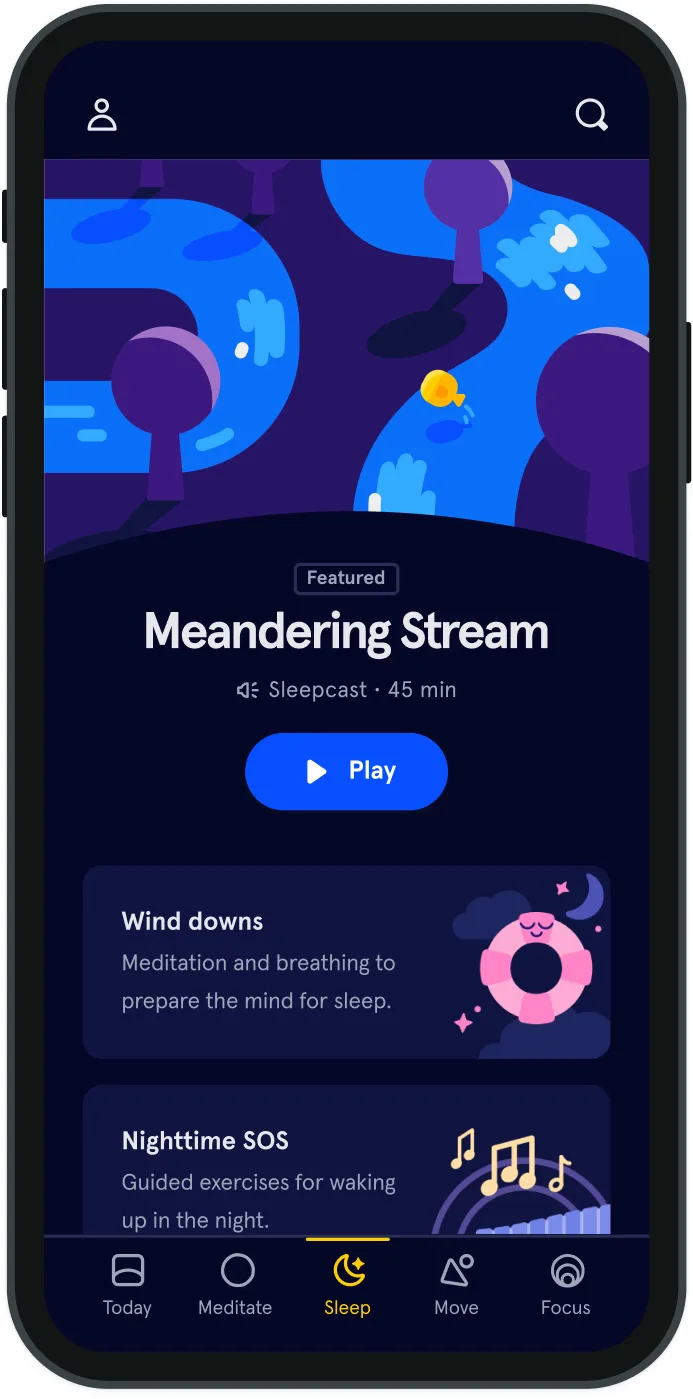

Be kind to your mind

- Access the full library of 500+ meditations on everything from stress, to resilience, to compassion

- Put your mind to bed with sleep sounds, music, and wind-down exercises

- Make mindfulness a part of your daily routine with tension-releasing workouts, relaxing yoga, Focus music playlists, and more

Meditation and mindfulness for any mind, any mood, any goal

Stay in the loop

Be the first to get updates on our latest content, special offers, and new features.

By signing up, you’re agreeing to receive marketing emails from Headspace. You can unsubscribe at any time. For more details, check out our Privacy Policy.

- © 2025 Headspace Inc.

- Terms & conditions

- Privacy policy

- Consumer Health Data

- Your privacy choices

- CA Privacy Notice